The electricity pricing recipe has been the same for decades. Electricity retailers set a price for power that includes a buffer for the ups and downs of the wholesale energy market, as well as covering all the other costs. However, now there is an alternative.

Market-linked electricity plans link the price you pay for grid electricity and receive for solar export, directly to the prevailing wholesale generation market price in your state. Given the wholesale market price can vary wildly from hour to hour and day to day, is it possible to save more under these high risk/high rewards plans?

Amber Electric and Powerclub arrive

In 2019, two new energy retailers, Amber Electric and Powerclub, launched their market-linked electricity plans into the contestable electricity markets in Australia (NSW, VIC, QLD, SA and ACT). Amber Electric and Powerclub have a similar pitch. Amber Electric “passes on the wholesale price of electricity to you”. While Powerclub provides “access to wholesale electricity prices”. Assuming they both pass through the same network costs, environmental levy and market fees, then the only difference should be their own costs as a retailer.

How they charge for their retail costs is slightly different:

- Amber charges $10 per month; and

- Powerclub charges a $39p.a. membership fee and requires a Powerbank balance of $16 per kWh of average daily usage (e.g. $240 for a 15kWh per day home) to cover the inevitable ups and downs in market rates.

Both Amber and Powerclub claim low overheads. As it’s not easy to assess that versus non-market linked plans, we’ll make a general comment that their retail margins look low and that’s a promising start.

Why get on a market-linked plan?

The opportunity to achieve savings with these plans goes beyond lower retail margins. The upside is really dependent on paying attention to the wholesale electricity price. To get the best deal, you need to limit the use of electricity when the market rates are high. Then be ready to shift your usage to when market rates are lower. Wholesale electricity rates can be as high as $14 per kWh or low as $0.01 per kWh. The average is around $0.10kWh.

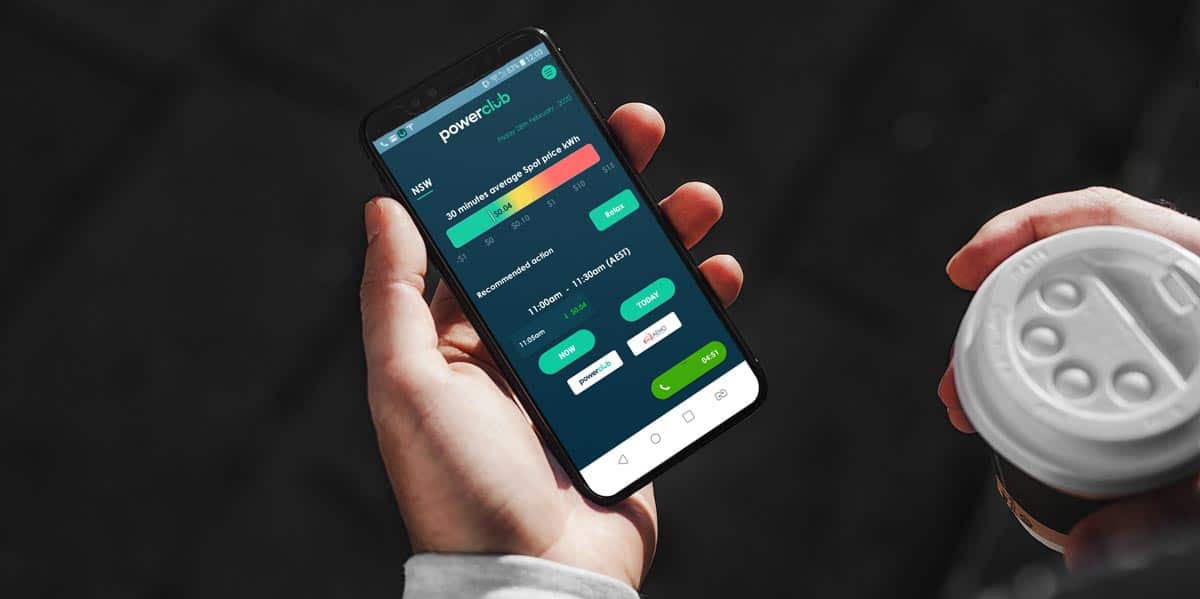

To benefit from the upside of cheaper rates and avoid the downside of costly rates, you’ll need to know what’s happening with prices and be flexible. So to make it easier to keep on top of wholesale price changes, both Amber Electric and Powerclub offer mobile apps for Apple and Android. Both apps show current and forecast rates and can provide you alerts if rates exceed a defined threshold.

Risk and reward by state

The variability of market prices differs significantly between States. In South Australia and Queensland where there are large amounts of solar, you’ll often find very low electricity prices in the middle of the day. However, in SA in particular, where higher cost gas is often used for evening power, then evening wholesale rates can be much higher. Plus households can be exposed to price spike rate events usually when demand is high and there are limits on supply (little solar/wind, fossil fuel generator failures or network failures). The chart below shows the number of high and low priced events by week.

The blue and green bars show the number of cheap half-hour periods (<5c kWh) to buy electricity. While the red bars show the expensive (25c+ kWh) half-hour periods that need to be avoided. We’ve only selected the peak solar hours of 10am-3pm to show the opportunities to buy cheap electricity, e.g. in SA in Spring of 2019 (lots of blue and green bars of cheap market electricity). Move the filters to see the opportunities and pitfalls of having a market-linked plan in your state, at different times of the day across the year.

What will help to make these plans achieve real savings?

Clearly, a willingness to change behaviour at peak times is essential if you want to do better with market-linked plans. And, if you have the funds, then a battery will undoubtedly make it easier. Solar storage can shield you from high import prices, allow you to charge at low prices and even let you export at higher rates.

Being able to shift loads when needed including through automation is also very beneficial. Flexible appliances such as pool pumps, air conditioning, and EVs, can be switched off during times of high rates and used at cheaper times.

What about solar?

Around 70% of WATTever’s site users have solar. So we’re very conscious of the impact of feed-in tariffs in many households energy bills. Unfortunately, this is where market-based plans fall short at present. Average wholesale rates during peak generation hours are relatively low at around 5c per kWh in 2019 (ironically, thanks to the successful adoption of rooftop and large-scale solar). Currently, many retailers offer high feed-in tariffs well above the average wholesale market rates. Some pay more than 15c per kWh for exported solar. I’ll note here that both Amber Electric and Powerclub claim to pay around 10c feed-in tariff. It seems they are having to push up the feed-in tariff they offer, above the wholesale average market pricing in 2019, to stay competitive.

Because of the high 15c+ feed-in tariffs, our view is that households exporting more solar than they import from the grid are likely to be worse off on market-linked plans. If you’re a net importer of electricity they may still be a good option.

Will a market-linked plan will work for me?

It’s not easy to accurately forecast how well a market-linked plan might work. That’s because there is no way of knowing future spot market prices. Equally, it’s hard to predict how much you will shift your usage to avoid high rates and use low rates. There’s a leap of faith that needs to be made and a commitment to be attentive to market prices if you’re up for the opportunity. I’d suggest the ingredients you’ll need to make this work are;

- the tools to receive alerts (mobile app access),

- a desire to respond and ideally technology that helps support this (being flexible with electricity appliance use/battery)

- low or no solar export

- you live in SA or QLD where there is a good portion of low rates to take advantage.

If, however, you live in the ACT, NSW or Victoria, it is a different story. In these areas the wholesale rate is less volatile, offering you only limited hours per month of cheap electricity. Here the upside potential of a market plan is not significant. At the same time, the downside means you’ll still have to keep an eye on market rates every day unless you have a battery or some automation.

What will make market plans more attractive?

Currently, the vast majority of market-linked plans use flat rate network tariffs. These plans have relatively high network rates (8-15c kWh). A better option would be to pair these market-linked plans with Time Of Use (ToU) off-peak tariffs where the network cost is lower (3-8c kWh). That way, households could buy electricity when the wholesale market and network rates are low, achieving a double saving.

With feed-in tariffs expected to fall over time, market-linked plans will become increasingly competitive for more households who are willing to make the effort.

We’ll be watching with interest to see if (and when) Time Of Use tariffs market-linked plans are launched. It will be interesting to see just how low prices will go during off-peak periods – both overnight and (in the not too distant future) the middle of the day.