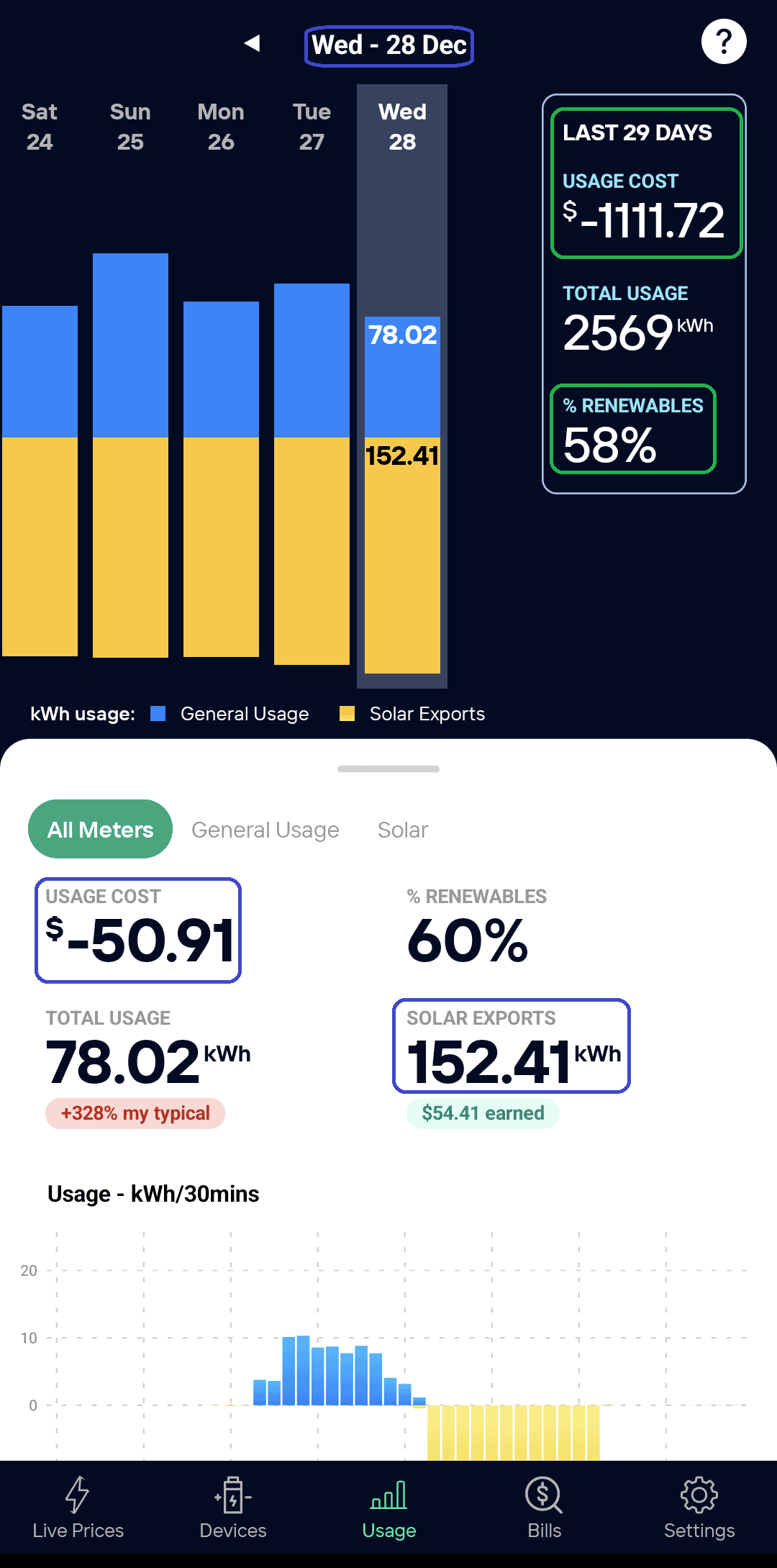

In this article, I’ll share how we doubled our returns by moving to a new two-way trial tariff with a 27.8 cent per kWh feed-in tariff and adding more storage to our home.

I have written previously about our first-hand experiences with a market-linked electricity plan. Over the first nine months, there were impressive returns from our solar and battery, assisted by some intelligent automation. Recently there was a new opportunity to step up the savings – and it’s something that others might do too.

New opportunities

In July 2022, a number of new trial tariffs were launched across Australia. These trial tariffs were designed to inform how networks and retailers can provide incentives to consumers to play a greater role in creating a more efficient grid, that reduces long-term costs for consumers. These trial tariffs include :

- residential two-way tariffs where networks offer an additional feed-in tariff to encourage households to export energy into the grid at times when demand on networks is high and charges for exporting when demand on networks is low;

- residential solar sponge tariffs where networks offer lower daytime usage charges to encourage households to use energy when demand on networks is low; and

- tariffs that support community batteries to import/export energy to balance demand within a network.

These initiatives enable consumers to actively engage and influence future tariff design for the 2024-29 regulatory period. Importantly, they allow networks to understand how pricing signals can achieve a material change in consumer behaviour to better manage demand in each network.

Hello, extra big FIT

As our home is in Sydney, the Ausgrid two-way trial tariff (aka EA959/EA960) [1] was available for us to try. And what a great tariff it is. The big feature of the Ausgrid two-way trial tariff is households receive an additional 27.8c per kWh credit for any exports between 2-8pm, 7 days per week. In effect, the network is paying a household that exports, the same amount they charge other households on the standard Time Of Use tariff (EA025) to import, during peak times. The goal is to encourage more local energy supply into the grid when network demand is high and less when demand is low.

Double dipping encouraged

27.8c per kWh is undoubtedly a high feed-in tariff, but it gets better than that. As an Amber customer, this network credit is passed directly through to the customer, along with the wholesale price. So if the wholesale electricity price in NSW between 2pm-8pm is:

- 0c per kWh, we receive a 27.8c per kWh feed-in tariff;

- 10c per kWh, we receive a 37.8c per kWh feed-in tariff; and

- 30c per kWh, we receive a 57.8c per kWh feed-in tariff!

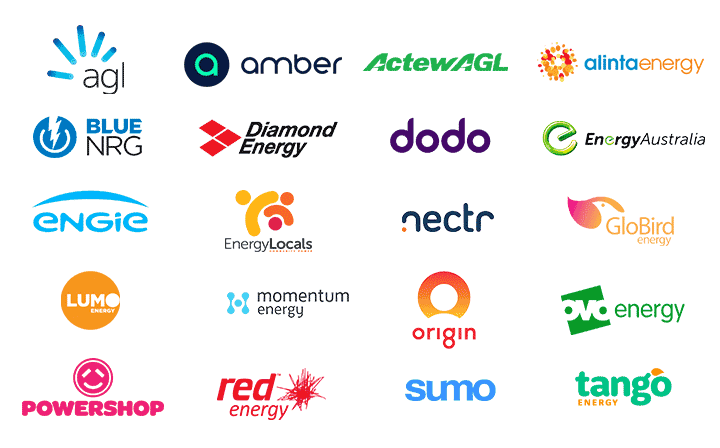

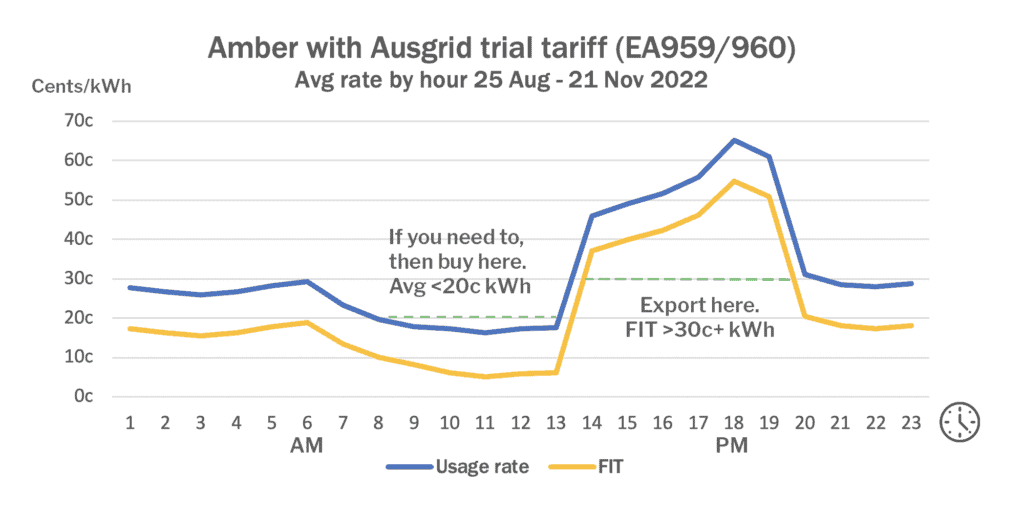

Here’s a chart of the average FIT with Amber on the Ausgrid trial over three months. This is typical of what happens across the day.

Price data source: Amber Price API

It’s worth highlighting that there is also a network charge of 1.85c per kWh for exports above 6kWh per day between 10am-2pm. You can see in the chart that the total average FIT drops as a result. This encourages households to self-consume their solar energy between 10am and 2pm. That’s because there’s an increasing amount of solar in the network during the midday window, which will eventually lead to grid stability issues (as has happened in parts of the Energex and SA Power networks).

For an average solar-only household, this could be a favourable tariff in October to March where a reasonable portion of solar (30+%) is generated and exported after 2pm with daylight savings. In winter though, a much smaller amount of solar would be generated, let alone exported after 2pm.

For an Amber customer, who can actively push stored energy into the grid late in the 2pm-8pm window as solar generations falls away, the potential for significant returns for supporting the grid are there all year round. With Amber, the price signals from Ausgrid and the wholesale market combine to provide a strong financial incentive to discharge batteries into the grid during hours of peak demand for both networks and generators.

What the new tariff is testing

The pricing signals in this two-way trial tariff are clear. The tariff provides pricing that encourages participating households to do the opposite of solar-only homes;

- import less energy between 2-8pm every day;

- export less energy between 10am-2pm every day; and

- export more energy between 2-8pm every day.

With this trial tariff, I expect Ausgrid are trying to understand what profiles can be achieved and the degree to which they can rely on battery owners to help them balance out other users on their network.

Retailers offering the trial tariff

As far as we are aware, there are only three retailers who offer plans that use the Ausgrid (aka EA959/960) two-way trial tariff:

- Amber passes through the network credit (27.8c per kWh exported from 2-8pm daily) and charge (1.85c per kWh for exports above 6kWh per day between 10am-2pm) to customers without change.

- Energy Locals Tesla Energy (TOU) plan offers a 30-cent feed-in tariff from 2-8pm daily but no feed-in tariff at any other time. This plan requires a Tesla Powerwall 2 – BYO or bought through Tesla Energy.

- On by EnergyAustralia Solar Home Bundle charges a flat rate for energy usage regardless of the time of day and no solar feed-in tariff. This deal offers fixed-rate electricity for seven years based on a contract with the retailer. It includes the installation of rooftop solar and storage which the home owner gets to keep at the end of the seven year contract period (so it’s not for existing solar or battery owners). The two-way tariff is used ‘under the hood’; presumably the retailer discharges some of the battery from 2-8pm to reduce the fixed usage rate the household pays across the seven years.

Each retailer is testing different ways of sending price signals to customers. Amber sends the full, unaltered price signal, Tesla Energy sends a partial price signal, and On by Energy Australia sends no price signal. Ausgrid can presumably see the import/export behaviour of consumers on the different plans and ascertain how effective each are at changing import/export patterns to meet Ausgrid’s objectives. Presumably Energy Locals and On by EnergyAustralia will control their fleet of batteries en masse to maximise their earnings. Whereas Amber customer’s discharge profiles will be somewhat different given that SmartShift targets maximum savings for each individual customer and that a portion of customers – like myself – will choose their own discharge profile.

Real life numbers

Since commencing the trial in late August 2022, we have been able to buy power from the grid through Amber for under 20c per kWh from 10am-2pm (on almost every day). This is a key benefit of the Amber model – access to lower cost power in the middle of the day (due to high levels of solar generation). When the sun goes down, the wholesale rates rise and with the uplift from the trial network credit, the feed-in tariff we receive for exporting from our battery has been ~45c per kWh.

In effect, the combination of the trial tariff and difference between midday and afternoon/evening wholesale rates results in a ~25c per kWh uplift for:

- energy we buy from the grid (and store) before 2pm and export before 8pm

- excess energy we generate from our rooftop PV (and store) before 2pm and export before 8pm

- excess energy we generate from our rooftop PV (and export) between 2pm and 8pm

Consistent low/high price hours allows for simple scheduling

With a market-linked plan like Amber offers, rates vary from hour to hour and day to day but the uplift noted above is remarkably consistent as the difference between daytime and evening wholesale prices is consistent through most days spring (regardless of weather).

The following chart shows the average of Amber’s usage rates and FIT across the day on the Ausgrid trail over a three month period.

Price data source: Amber Price API

You can see a clear patten of when to schedule the charging and discharging of our battery. So we charge our battery from our own solar system and buy from the grid (as late as possible) so it’s full at 2pm. In the evening we export from the battery (again as late as possible) so the battery is at 20% at 8pm. That 20% state of charge is enough to get through to the next morning when our solar starts filling the battery again.

Every households experience will depend on exactly when and how much they choose to import and export. Here are our average usage rates and feed-in tariffs from September 2022 on the Ausgrid two-way tariff trial:

"Our average feed-in tariff during the first 12 months of the trial period has been 48c per kWh while the average cost of grid power has been just 14c per kWh."

| Month | Avg Usage Rate | Avg Feed-in Tariff | Difference |

|---|---|---|---|

| Sep 2022 | 15c | 51c | -36c |

| Oct 2022 | 18c | 44c | -26c |

| Nov 2022 | 12c | 40c | -28c |

| Dec 2022 | 9c | 37c | -28c |

| Jan 2023 | 14c | 40c | -26c |

| Feb 2023 | 13c | 40c | -27c |

| Mar 2023 | 15c | 55c | -40c |

| Apr 2023 | 14c | 49c | -35c |

| May 2023 | 17c | 81c | -64c |

| Jun 2023 | 15c | 51c | -36c |

| Jul 2023 | 13c | 43c | -30c |

| Aug 2023 | 13c | 47c | -34c |

| Sep 2023 | 10c | 38c | -28c |

| Oct 2023 | 10c | 29c | -19c |

| Nov 2023 | 14c | 39c | -25c |

| Dec 2023 | 13c | 35c | -22c |

| Jan 2024 | 15c | 34c | -19c |

| Feb 2024 | 14c | 50c | -36c |

| Mar 2024 | 14c | 35c | -21c |

| Apr 2024 | 13c | 40c | -27c |

| May 2024 | 18c | 101c | -83c |

| Jun 2024 | 18c | 50c | -32c |

| Sep 2022 to Jun 2024 (trial period) | 14c | 47c | -33c |

| Jul 2024 | 12c | 35c | -23c |

| Aug 2024 | 11c | 75c | -64c |

| Sep 2024 | 7c | 18c | -11c |

| Oct 2024 | 9c | 24c | -15c |

| Nov 2024 | 13c | 110c | -97c |

| Dec 2024 | 13c | 45c | -32c |

| Jan 2025 | 7c | 25c | -18c |

| Feb 2025 | 7c | 25c | -18c |

| Mar 2025 | 7c | 36c | -29c |

| Apr 2025 | 7c | 31c | -24c |

| May 2025 | 10c | 44c | -34c |

| Jun 2025 | 11c | 122c | -111c |

| Jul 2025 | 10c | 24c | -14c |

| Aug 2025 | 10c | 25c | -15c |

| Sep 2025 | 5c | 20c | -15c |

| Oct 2025 | 6c | 19c | -13c |

| Nov 2025 | 4c | 29c | -25c |

| Dec 2025 | 10c | 17c | -7c |

| Jan 2026 | 9c | 34c | -25c |

Similar rates could be achieved by others with Amber on this tariff. As long as they have enough battery to store most of the solar that they would otherwise export before 2pm.

The following table shows how by arbitraging the market rates, we’ve been importing (mostly charging our battery) when renewables are a higher proportion of grid generation and exporting (solar and battery discharging) when renewables are a lower proportion of grid generation.

| Month | Avg Import Renewables | Avg Export Renewables | Difference |

|---|---|---|---|

| Sep 2022 | 47% | 12% | 35% |

| Oct 2022 | 45% | 26% | 19% |

| Nov 2022 | 57% | 38% | 19% |

| Dec 2022 | 57% | 40% | 17% |

| Jan 2023 | 51% | 34% | 17% |

| Feb 2023 | 55% | 31% | 24% |

| Mar 2023 | 49% | 22% | 27% |

| Apr 2023 | 51% | 11% | 40% |

| May 2023 | 46% | 7% | 39% |

| Jun 2023 | 41% | 7% | 34% |

| Jul 2023 | 45% | 7% | 38% |

| Aug 2023 | 51% | 12% | 39% |

| Sep 2023 | 66% | 29% | 37% |

| Oct 2023 | 61% | 48% | 13% |

| Nov 2023 | 57% | 40% | 17% |

| Dec 2023 | 58% | 43% | 15% |

| Sep 2022 to Dec 2023 | 52% | 25% | 27% |

Effectively we are buying and storing predominantly renewables-sourced energy and exporting it later when fossil fuels dominate in NSW. Thus we are increase grid demand between 9:30am to 2pm, supporting more solar in the grid and, on occasion, reducing the curtailment of large renewable generators when demand is low. And when exporting between 2pm-8pm, we are reducing grid demand by supplying many of our neighbours with electricity sourced from our own solar and predominantly renewables pulled from the grid earlier in the day. We push exports from our battery to as late a time as possible in the 2-8pm window, usually discharging between 4:30pm-8pm to maximise returns and reduce fossil fuel usage.

It’s interesting to note that in September, the level of renewables in the grid in NSW when exporting was just 12%. This is due to both less daylight hours and daylight saving impacting how late in the day solar generates. Moving to December, there were a lot more renewables in the grid up to 8pm. In winter we expect to be exporting when the level of renewables is in the single digits in NSW as solar generation ends around 4pm each day.

We need a lot more wind and storage to raise the portion of winter renewables but at least we’re doing our bit to help!

Credit where it’s due

In September and October, the first two full months on the trial tariff, we achieved credits of ~$500 per month (with >~50kWh storage). Better weather, less shade and adding 25kWh of additional storage means we are on track for a credit of over $900 for November. If we see some really sunny weather and price spikes over summer, there’s potential to exceed $1,000 credit in one month! However it’s not just about the financial rewards we earn, as we’re actively supporting:

- the local network through reducing evening peak demand

- renewable generation by buying over 2,000kWh of mostly renewable power from the NSW grid (54% renewables in November) and discharging that power into the grid

- reducing the demand for expensive fossil fuels (which are used to power ~90% of NSW’s grid around 8pm) by discharging stored power into the grid in the evening.

Any battery can do well

Naturally with smaller storage capacity, monthly bill credits would have been smaller. However the difference between average buy and sell prices can be better as a small battery household is likely to buy grid power for shorter time periods e.g. 12pm-2pm at lower prices (or not at all if they have sufficient solar), and export later in the day, say 6-8pm when wholesale rates are at their highest.

The takeaway here is – the margin between sell rates and buy rates should be the same or better for those with (smaller) batteries that can be charged/discharged more quickly. Certainly this tariff encourages households to add more storage but the payback period will be longer for each additional kWh of capacity unless you can import and export in the same narrow window as a smaller battery.

Next stop – a more rewarding relationship

The Ausgrid two-way trial tariff is scheduled to run until June 2024. Let’s hope more networks offer similar tariffs in the future and by doing so recognise that some consumers can and want to be active players in the energy market (given the right price signals) and transition to 100% renewables.

How to get onboard for Amber’s Ausgrid trial.

You can head here to find out more about Amber including signing up*. Network rules mean that only a customer’s current retailer can action a tariff change of their behalf – so you’ll need to join Amber first. Then to access Ausgrid’s bonus export tariff, eligible customers should email info@amber.com.au and request to be moved to EA959 – Residential two-way tariff.

*Things to know: Amber Electric is a WATTever product partner and WATTever may earn a referral fee when new customers join Amber.

Information contained in this article is general energy saving advice and does not take into account your individual circumstances, objectives, financial situation or needs. You are responsible for the choice of your energy retailer, so it’s important that you read the Energy Fact Sheets at www.amber.com.au/factsheets along with the Retailer’s Terms and Conditions to get it right.

Footnotes:

[1] Here’s the link to the Ausgrid networks tariff trial notification which explains the trial. Please note that rates referenced in Ausgrid’s document are 2021-22 and new rates apply from July 1 2022. It is up to participating retailers to determine what portion of the network FIT they share with customers and how information about the network trial is communicated.