The 2022 DMO VDO increase.

Default offers are a safety net for households and small businesses. These prices apply to those on standing offers, capping the price consumers pay for electricity for those who don’t choose a market offer. Around one in ten households (about 550,000 customers) are impacted by the Default Market Offer (DMO) and Victorian Default Offer (VDO). For 2022-23, the DMO and VDO price increases for households:- Victoria – 1% to 9%

- NSW – 8.5% to 14.1%

- SE QLD – 11.3%

- SA – 7.2%

Bigger hit to market offers

The pain will be worse for those on market offers. Many retailers are scrambling to buy electricity at a cost that looks remotely like what they paid last year. As a result, a lot of retailers will struggle to provide deals that are much better than Default Offer – if they can even do that. We expect to see a decrease in the discount levels offered. We’ll break out why seventeen retailers have already removed their NSW and SE QLD market offers.Wholesale rates have exploded in NSW and QLD

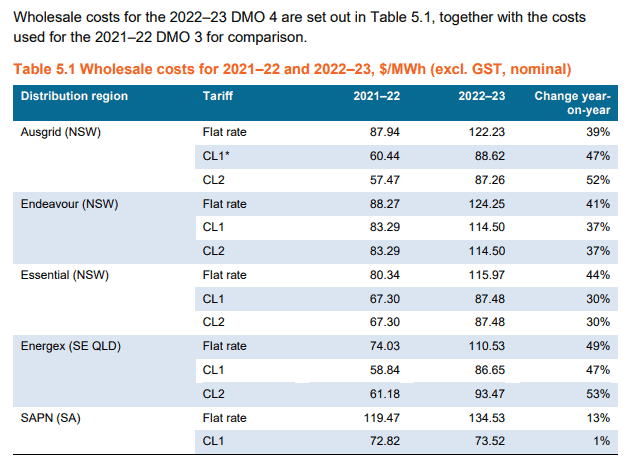

The increases in the 2022 DMO and VDO look very modest compared to the wholesale spot and future prices. Wholesale prices have increased 100-200% in the last six months. The wholesale rates for baseload contracts for Q3 2022 can be seen in the chart below and are currently around ~25c per kWh. These are one of the contracts retailers use to lock in pricing for the electricity used by their customers. Current spot prices are even higher, averaging 35 cents overnight and 25-30 cents during the day in NSW. Prices for these contracts were under 8c just six months ago. We are now witnessing unprecedented energy costs that retailers face when buying electricity for their customers. Compare these rates with the table below. This shows wholesale rates of 11-15c per kWh that the DMO prices are predicated on:

Prices for these contracts were under 8c just six months ago. We are now witnessing unprecedented energy costs that retailers face when buying electricity for their customers. Compare these rates with the table below. This shows wholesale rates of 11-15c per kWh that the DMO prices are predicated on:

The DMO is shaking up the market

Based on futures pricing and feedback from retailers, the DMO price doesn’t reflect the actual cost increase that many retailers will see for 2022-23. Especially retailers that had not locked in pricing before April 2022 to cover their customers’ electricity consumption for the next 12 months. So, we can’t see how they will be able to offer customers plans at the Default Market Offer in NSW and QLD without losing money. As a result, small retailers are removing all their market offers. Some are not taking on any new customers, while others have told their existing customers they should shop around.Around half of all retailers ditch market offers

As of 5th June 2022, over twenty-five electricity retailers have removed their market offers in NSW and QLD, including:- 1st Energy

- Amber – only accepting new customers with solar and battery

- Bright Spark Power

- CovaU

- Diamond Energy – not accepting new customers until new rates published

- Dodo – removed from QLD only

- Discover Energy

- Electricity in a Box

- Elysian Energy

- Future X Power

- GEE Energy

- Locality Planning Energy

- Mojo Power

- Momentum Energy

- Nectr

- OVO Energy

- People Energy

- Pooled Energy (in administration)

- Powerdirect

- Powershop

- QEnergy

- Radian Energy

- ReAmped Energy

- Simply Energy

- Smart Energy

- Tango Energy

Exiting the market.

Last week, Pooled Energy appointed administrators. We expect that more retailers will leave the market in the coming months. While other retailers are sitting out the storm and not seeking new customers.Less competition ahead.

We expect many retailers will be engaging the AER to tell them that they will not be able to sell electricity at the DMO unless it is revised upwards. Based on the response to retailer submissions to the draft determination, we reckon it’s unlikely to be revised.

It’s now a waiting game until early July to see which retailers will offer plans and at what rates. Retailers with generation (gentailers), or small retailers with sufficient contracts/hedging, should be able to provide plans at or just below the default market offer rates. Small, discount retailers that previously offered lower-cost plans will struggle. So, expect a significant drop in competition in the retail market in the coming months.

Large gentailers should be well-positioned to move to the top of the plan rankings and win customers. Even though their rates are higher than consumers have been accustomed to over the last 2-3 years. This is already happening.

What can you do

Savvy consumers will be looking at fixed rate offers before June 30. Those who own their own rooftop may consider adding or expanding solar and looking at adding battery. Payback periods for solar and battery will improve significantly from July in both NSW and QLD (and to a lesser degree in the other states). We expect solar in NSW will be well under a five year payback period with battery payback under ten years for batteries (for those with low $ per kWh).

Extended switching season

Households willing to shop around over the next year or two will be able to switch to the retailers who have done the best job at forecasting future rates. So if you find yourself with a retailer who hadn’t locked their prices in before they exploded, it’s easy to switch to one that has.

The months ahead will be rocky. But a calm head will see most well-positioned to avoid the worst of the price increases. We hope that we all come out of this better shielded from fluctuating coal and gas prices. Ultimately, lower-cost renewables powered by free sunshine, wind and gravity should offer Australia a future of stable power prices.